Investing carries serious risks, including partial or total loss of capital. Please read the Key Investment Information Sheet and the Risk factors and login before investing.

Pacaya 1A

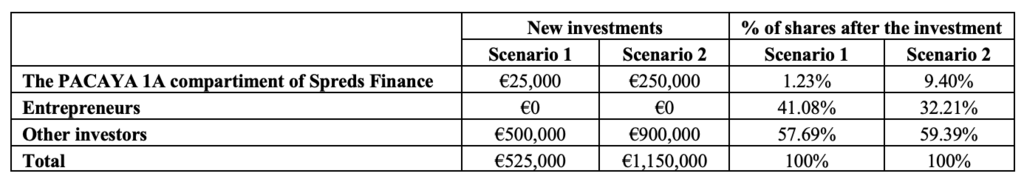

The PACAYA 1A compartment of Spreds Finance would participate in the financing of LUCKY WAY GAME BV/SRL planned between € 525,000 and € 1,150,000 (the "Capital Increase").

Of the total amount raised during the period of the offering, Spreds Finance will use an amount of € 500 per Participatory Notes for these purposes, subject to the fulfilment of the conditions for such placement.

Of the total amount raised during the period of the offering, Spreds Finance will use an amount of € 500 per Participatory Notes for these purposes, subject to the fulfilment of the conditions for such placement.

Cumulative conditions precedent

The minimum subscription amount per investor is €500.

The minimum offering amount is €25,000.

The Notes will only be issued if, within 6 months from the Closing Date, the following listed cumulative and conditions precedent to the subscription of shares of LUCKY WAY GAME by Spreds Finance (see below) are met:

The minimum offering amount is €25,000.

The Notes will only be issued if, within 6 months from the Closing Date, the following listed cumulative and conditions precedent to the subscription of shares of LUCKY WAY GAME by Spreds Finance (see below) are met:

- The total amount of firm commitments in this financing round shall be at least €525,000 and not more than €1,150,000. Amounts contributed in kind are included in these commitments.

- The capital increase will be realized on the basis of a pre-money valuation of €1,500,000. It is at this pre-money valuation that the conversion of the institutional investor's convertible loan will take place (with a 5% discount). Cash contributions will then be made. In order to comply with the 5% discount and on the basis of a €250,000 contribution in kind, the pre-money valuation for cash contributions will be €1,760,000. It is important to note, however, that if any interest due on the institutional investor's loan is also converted into shares, the pre-money valuation will have to be increased (in order to comply with the 5% discount). Thus, if an interest amount of €10,000 were also converted, the pre-money valuation for the cash contribution would be €1,769,800.

- Spreds Finance will participate in the capital increase for an amount equal to the result of the subscription to Participatory Notes of the PACAYA 1A Compartment. This amount must be at least €25,000.

Spreds Finance verifies that such conditions precedent are met no later than 6 months after the Closing Date ("Effective Date"), i.e. 27/11/2024. In the event that one or more of these conditions are not met by the Effective Date, the Notes will not be issued and the Subscription Amount paid by the Investors respectively will be refunded no later than 15 business days after the Effective Date.

Subscription period

The subscription period begins on 27/02/2024 and ends on the Closing Date, which is in principle 27/05/2024.

It may be decided to extend the subscription period by 3 months (until 27/08/2024 at the latest), if the total amount of subscriptions on 27/05/2024 is at least €20,000.

The offering may be closed early once the minimum offering amount, of €25,000, has been reached. Early closure of the offer may also be decided if the total amount of orders contained in the subscription forms signed and transferred to Spreds Finance reaches the maximum amount of the offer.

Investors who have subscribed to the Participatory Notes before any extension of the subscription period will be notified by e-mail and will have the right to withdraw their investment for 4 calendar days, starting from the day of sending this e-mail.

The Participatory Notes will be issued on the date of the capital increase, if the conditions for issuing these Participatory Notes are met. That is, at the latest on 27/11/2024 if the subscription period ends on 27/05/2024. This may be earlier (if the offering closes early) or later (if the subscription period is extended).

It may be decided to extend the subscription period by 3 months (until 27/08/2024 at the latest), if the total amount of subscriptions on 27/05/2024 is at least €20,000.

The offering may be closed early once the minimum offering amount, of €25,000, has been reached. Early closure of the offer may also be decided if the total amount of orders contained in the subscription forms signed and transferred to Spreds Finance reaches the maximum amount of the offer.

Investors who have subscribed to the Participatory Notes before any extension of the subscription period will be notified by e-mail and will have the right to withdraw their investment for 4 calendar days, starting from the day of sending this e-mail.

The Participatory Notes will be issued on the date of the capital increase, if the conditions for issuing these Participatory Notes are met. That is, at the latest on 27/11/2024 if the subscription period ends on 27/05/2024. This may be earlier (if the offering closes early) or later (if the subscription period is extended).

Investments already confirmed

Three investors (shareholders from the 1st hour, having participated in the 1st financing round 2 years ago) will reinvest in this financing round in equity, outside the present offer, for a total amount of around €200,000.

Also in this round, LUCKY WAY GAME will be joined by 2 new equity investors:

- An institutional investor (250K€) (It should be noted that in addition to a 250K€ equity investment, a convertible loan of 250K€ granted about a year ago will be converted into shares, with a 5% discount on the valuation); and

- Another investor (50K€).

The table below is based on a pre-money valuation of €1,760,000 for cash contributions. It should be noted that a pre-money valuation of €1,500,000 is to be taken as the base pre-money valuation. It is at this pre-money valuation that the conversion of the institutional investor's convertible loan will take place (with a 5% discount). Investors may note that a discount on conversion of a convertible loan is very common in the market. Then the cash contributions will take place. In order to respect the 5% discount and on the basis of a €250,000 contribution in kind, the pre-money valuation for cash contributions will be €1,760,000.

It is important to note that if any interest due on this institutional investor's loan is also converted into shares, the pre-money valuation will have to be increased (in order to comply with the 5% discount). Thus, if an interest amount of €10,000 were also converted, the pre-money valuation for the cash contribution would be €1,769,800. The table below is based on a contribution in kind by the institutional investor of €250,000. Percentages have been rounded to two decimal places.

Scenario 1: The funding round reaches its minimum targets. Through this offer, the minimum required to validate the round is raised. The entrepreneurs and other investors invest only what they have committed to invest or the difference between the minimum target of the round and the investment of the PACAYA 1A compartment of Spreds Finance.

Scenario 2: The financing round reaches its maximum targets. The maximum amount of this offer is reached and the entrepreneurs and other investors invest the difference between the maximum objective of the round and the maximum investment of the PACAYA 1A compartment of Spreds Finance.

As mentioned above, the company has already been able to secure funds from existing shareholders and new investors. In particular, the company will receive €500,000 in cash and €250,00 in kind (at a 5% discount to valuation).

Scenario 1 above assumes that the institutional investor's loan will not be converted. In this case, there would only be cash contributions.

Scenario 2 provides for the case where the institutional investor's converts its loan up to €250,000 and, in addition to the €250,000 raised through the present offer and the €500,000 through commitments already confirmed, an amount of €150,000 is still invested as a cash contribution by one or more currently unidentified investor(s).

Please note that as a result of the different pre-money valuation, the information show in the table "Raise summary" may not be fully accurate. Please refer to the information provided here above for an accurate image.

Fact sheet

| Advised by a professional start-up advisor | |

| Valuation is set by the co-investor or incubator | |

| Co-investor or incubator will be members or observers to the board | |

| At the closing, an incubator, accelerator, or studio will have shares | |

| At the closing, the entrepreneurs have contributed a minimum of €15,000 in cash in exchange for shares | |

| Emits less than 3.7 t of CO2 per year, per employee | |

| At the closing, a professional co-investor will have invested at least €25,000 | |

| Prior fundraising in equity or convertible loan with 10 or more investors | |

| Seasoned entrepreneurs | |

| Considered “compliant” on the assessment tool of Tapio | |

| Minimum 2 active entrepreneurs | |

| Valuation set by an organisation specialized in valuations of comparable size | |

| Valuation is less than €1 million or 10x last year’s turnover |

Raise summary

| Crowd investments | €11,000 |

| Committed by others | €500,000 |

| Amount raised | €511,000 |

| Minimum round | €525,000 |

| Maximum round | €1,150,000 |

| Shares in the company (total round) | 43.396% |

| Pre-money valuation | €1,500,000 |

| Post-money valuation min. | €2,025,000 |

| Post-money valuation max. | €2,650,000 |